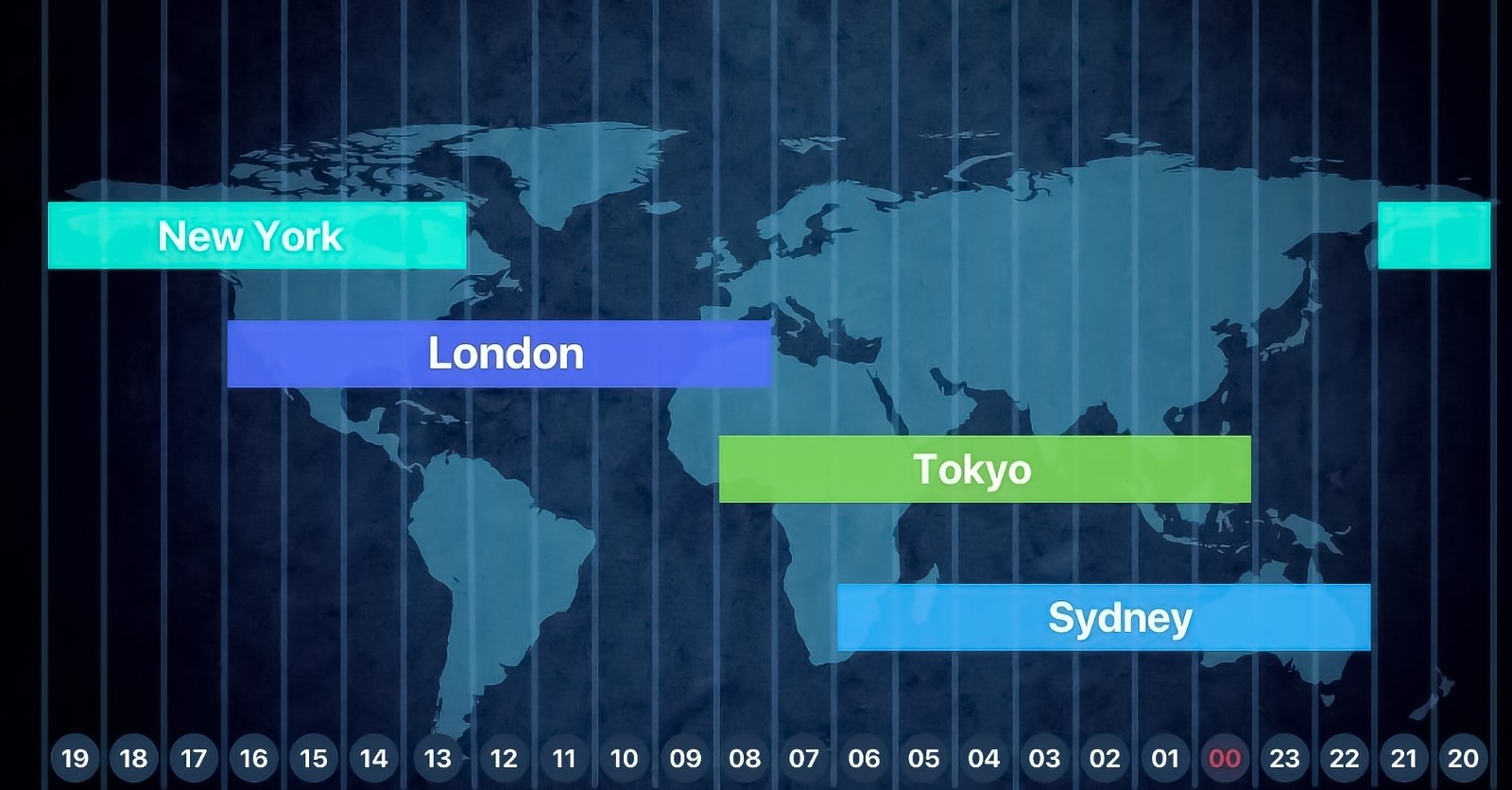

Global market hours refer to the trading hours of financial markets around the world, including stock exchanges, commodity markets, bond markets, and foreign exchange (Forex) markets. These markets have specific opening and closing hours, and their trading sessions often overlap to some extent, allowing for continuous trading activities. Here's a general overview of global market hours for some of the major financial markets:

Traders and investors should always check the specific market hours and trading schedules for the assets they are interested in trading, as well as any holiday closures or early market closures that may impact their trading activities. Additionally, global market hours can be affected by daylight saving time changes in different regions, so it's essential to stay informed about these adjustments.

With our comprehensive guide to global market hours, you can navigate the dynamic world of Forex trading.

Stay informed about market hours and make strategic trading decisions. Whether you're a seasoned trader or a newcomer, understanding these market hours is vital for navigating the dynamic world of Forex.

The Chicago Mercantile Exchange (CME) stands as one of the world's leading and most diverse financial exchanges, playing a pivotal role in global derivatives and futures markets. Here's an overview:

Founded in 1898, the CME has a rich history of innovation and adaptation to changing financial landscapes.

CME offers a broad array of financial products, including futures and options on interest rates, equity indexes, commodities, foreign exchange, and more.

As a global marketplace, the CME attracts participants from various corners of the world, contributing to its liquidity and market depth.

The CME has embraced technology with electronic trading platforms, enabling efficient and seamless transactions for market participants.

Market participants use CME products for effective risk management, hedging against price fluctuations in various financial instruments.

CME's futures contracts often serve as benchmarks for global commodities and financial markets, influencing pricing and risk management strategies.

Known for fostering financial innovation, the CME continually introduces new products and derivatives to meet the evolving needs of market participants.

Note: For real-time information on CME products, trading hours, and market updates, refer to the official CME Group website.

The Chicago Mercantile Exchange remains a cornerstone in the financial landscape, providing a platform for effective risk management and price discovery across a wide spectrum of assets.

Note: This overview is for informational purposes only and may be subject to change. For accurate and up-to-date information, refer to the official CME Group website.

The London Metal Exchange (LME) stands as a global center for the trading of industrial metals, providing a platform for price discovery, risk management, and hedging. Here's a brief overview:

Founded in 1877, the LME has a long-standing history as the world's premier non-ferrous metals market.

Specializing in non-ferrous metals such as copper, aluminum, zinc, lead, nickel, and tin, the LME serves as a vital market for producers, consumers, and traders.

The LME is a key source for global price discovery in the metals industry, influencing commodity prices worldwide.

Market participants, including producers and consumers of metals, use the LME to hedge against price volatility, managing their exposure to market fluctuations.

Traditionally known for open outcry trading, the LME has embraced electronic trading, providing flexibility and efficiency to market participants.

The LME operates a unique warehousing system, allowing participants to store and deliver metals, contributing to the physical market dynamics.

With a diverse range of participants from around the world, the LME ensures liquidity and depth in its markets.

Note: For the latest information on LME metals, trading rules, and market updates, refer to the official London Metal Exchange website.

The London Metal Exchange remains a cornerstone in the metals industry, providing essential services for price discovery and risk management in the dynamic world of commodities.

Note: This overview is for informational purposes only and may be subject to change. For accurate and up-to-date information, refer to the official London Metal Exchange website.

Bond markets play a crucial role in the global financial system, providing a platform for governments, corporations, and other entities to raise capital. Here's an overview of key aspects related to bond markets:-

Note: Understanding bond markets is essential for investors seeking income, diversification, and a nuanced understanding of the broader financial landscape.

Note: This overview provides general information and may not cover all aspects of bond markets. Investors should conduct thorough research and consider their risk tolerance before participating in bond markets.

The Foreign Exchange (Forex) market, also known as the currency or FX market, is the largest and most liquid financial market globally. Here's an overview of key aspects related to Forex markets:-

Note: Understanding Forex markets is essential for participants seeking to capitalize on currency fluctuations. It requires a solid understanding of market dynamics, risk management, and analysis techniques.

Note: This overview provides general information and may not cover all aspects of Forex markets. Traders should conduct thorough research and consider their risk tolerance before participating in Forex trading.

Cryptocurrency markets represent a dynamic and decentralized sector characterized by digital or virtual currencies. Here's an overview of key aspects related to cryptocurrency markets:-

Note: Understanding the intricacies of cryptocurrency markets involves a deep dive into blockchain technology, market dynamics, and the evolving regulatory landscape. Potential participants should conduct thorough research and exercise caution due to market volatility.

Note: This overview provides general information and may not cover all aspects of cryptocurrency markets. Participants should stay informed about market developments and exercise due diligence.